Why Diversification is Key in Any Investment Portfolio

- Dushyant Bisht

- Sep 16, 2025

- 9 min read

Updated: Jan 10

Table of Contents

The $2.4 Trillion Lesson from 2022

The Science Behind Diversification

Types of Diversification Strategies

Current Market Applications (2025 Context)

Practical Implementation Strategies

Diversification Limitations and Misconceptions

Future of Portfolio Diversification

Conclusion and Actionable Steps

The $2.4 Trillion Lesson from 2022

Global stock markets hemorrhaged $2.4 trillion in 2022, yet something remarkable happened: diversified portfolios outperformed concentrated investments by 15-20%. This wasn't luck—it was science in action.

While headlines screamed about market crashes, investors who understood investment portfolio diversification watched their carefully constructed portfolios weather the storm far better than those betting everything on single stocks or sectors. The lesson? In 2025's increasingly volatile market environment, diversification isn't just smart—it's essential for survival.

Today's investment landscape presents unprecedented challenges. Geopolitical tensions, inflation concerns, and rapid technological disruption create a perfect storm of uncertainty. Yet within this chaos lies opportunity for those who understand how to spread risk intelligently across asset classes, geographies, and time horizons.

This comprehensive guide reveals why portfolio diversification strategies form the foundation of resilient wealth building. We'll explore the mathematical principles that make diversification work, examine current market opportunities, and provide actionable frameworks for building portfolios that protect and grow your wealth regardless of market conditions.

Whether you're managing a modest retirement account or substantial investment capital, understanding diversification could be the difference between financial security and devastating losses.

The Science Behind Diversification

Modern Portfolio Theory Foundations

Harry Markowitz revolutionized investing in 1952 with a breakthrough insight that earned him the Nobel Prize: an asset's risk and return shouldn't be evaluated in isolation, but by how it contributes to a portfolio's overall performance. The Modern Portfolio Theory forms the mathematical foundation for all diversification strategies.

The core principle is elegantly simple yet powerful: combining assets that don't move in perfect sync reduces overall portfolio risk without sacrificing returns. Markowitz proved that investors could achieve better risk-adjusted returns by holding a diversified mix of investments rather than putting all their money into even the best-performing single asset.

Key Takeaway: The efficient frontier demonstrates that optimal portfolios always include multiple assets, creating superior risk-return combinations impossible with single investments.

Correlation and Risk Reduction

Understanding correlation is crucial for effective asset allocation diversification. Correlation coefficients range from -1 (perfect negative correlation) to +1 (perfect positive correlation), with 0 representing no relationship.

Investment diversification benefits emerge when combining assets with low or negative correlations. For example, bonds often rise when stocks fall, providing a natural balance in portfolios. Real assets, such as commodities or maritime investments, often move independently of traditional financial markets, offering additional diversification benefits.

The mathematics are compelling: properly diversified portfolios can reduce volatility by up to 80% compared to single-asset investments, while maintaining similar return potential. This risk management diversification eliminates what economists call "idiosyncratic risk"—risks specific to individual companies or sectors.

Real-World Evidence

Decades of market data validate the effectiveness of diversification. During the 2008 financial crisis, diversified portfolios lost an average of 22%, while concentrated portfolios often dropped 40-60%. Similarly, in 2020's COVID-19 market crash, balanced portfolios recovered within months, while single-sector investments took years.

Recent 2025 market conditions further demonstrate the value. As inflation pressures persist and geopolitical tensions create volatility, portfolios diversified across asset classes, geographies, and investment styles continue to outperform concentrated strategies by significant margins.

Types of Diversification Strategies

Asset Class Diversification

Traditional Asset Allocation

The foundation of any diversified portfolio includes stocks, bonds, cash equivalents, and real estate. However, modern portfolio diversification strategies extend far beyond these basics.

Stocks offer growth potential but carry a risk of volatility. Bonds offer stability and income but face interest rate sensitivity. Real estate delivers inflation protection and tangible value. Cash provides liquidity and stability, but offers minimal growth opportunities.

Alternative Investment Integration

Today's sophisticated investors are increasingly incorporating alternatives, including commodities, REITs, private equity, hedge funds, and emerging asset classes such as tokenized maritime investments. These alternatives often exhibit low correlation with traditional assets, enhancing diversification benefits.

For example, maritime asset tokenization platforms allow fractional ownership of commercial vessels, providing exposure to global trade revenues with minimal correlation to stock market movements. This represents the evolution of diversification into previously inaccessible asset classes.

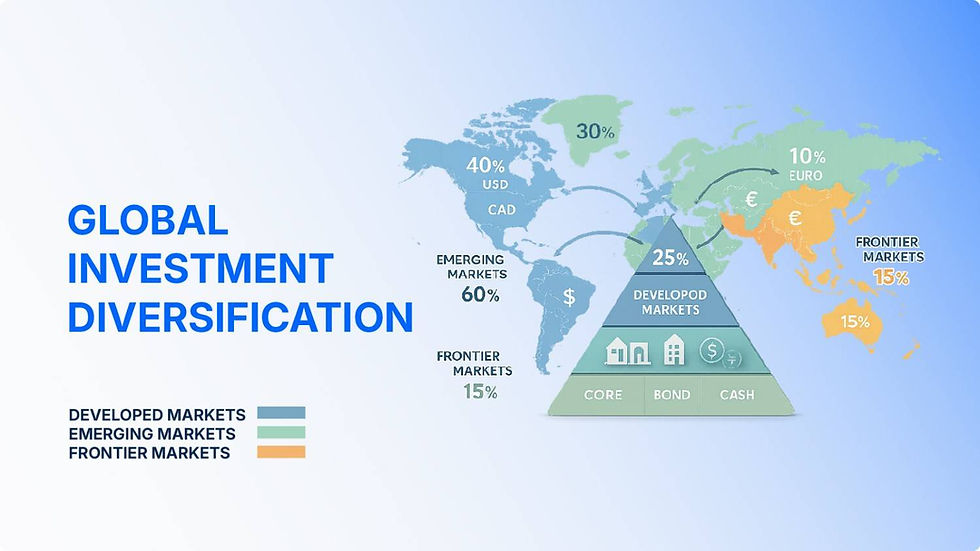

Geographic Diversification

International Market Exposure

Geographic diversification protects against country-specific risks while capturing global growth opportunities. Morgan Stanley recommends broadening portfolios with non-U.S. equities, particularly in the interconnected yet regionally volatile market environment expected in 2025.

Developed markets offer stability and established regulatory frameworks. Emerging markets provide higher growth potential but increased volatility. Frontier markets present significant opportunities with corresponding risks.

Currency and Regional Balance

Multi-currency exposure provides natural hedging against domestic currency weakening. Regional diversification encompasses different economic cycles, with some economies expanding while others contracting.

Sector and Industry Diversification

Economic Cycle Positioning

Different sectors perform better during various economic phases. Technology and consumer discretionary stocks tend to outperform during periods of growth, while utilities and consumer staples offer stability during downturns.

Future-Focused Allocation

2025 portfolio construction should include exposure to transformational trends: artificial intelligence, renewable energy, biotechnology, and infrastructure modernization. However, balancing innovation exposure with established industry stability remains crucial.

Defensive Positioning

Including defensive sectors—such as healthcare, utilities, and consumer staples—provides portfolio stability during uncertain periods. These sectors often maintain steady revenues regardless of economic conditions.

Time Diversification

Dollar-Cost Averaging Benefits

Spreading investment timing through regular, systematic purchases reduces market timing risk. This strategy is particularly beneficial for volatile asset classes, helping to smooth return patterns over time.

Strategic Rebalancing

Regular portfolio rebalancing maintains target allocations and encourages disciplined buying at low prices and selling at high prices. Quarterly or semiannual rebalancing typically yields optimal results without incurring excessive transaction costs.

Current Market Applications

2025 Market Environment Challenges

Current market conditions make diversification more critical than ever. Persistent inflation pressures, geopolitical tensions, and technological disruption create unprecedented volatility across traditional asset classes.

Interest rate uncertainty affects bond valuations while equity markets struggle with valuation concerns. These conditions reward investors who understand how to position portfolios across multiple asset classes and investment styles.

Inflation Protection Requirements

Traditional 60/40 stock-bond portfolios face challenges in inflationary environments. Modern diversification encompasses real assets—such as commodities, infrastructure, and real estate—that often benefit from inflation rather than suffer from it.

Modern Diversification Opportunities

ESG and Sustainable Investing

Environmental, social, and governance investments represent both values-driven and performance-driven opportunities. Clean energy, sustainable agriculture, and responsible maritime operations offer diversification benefits while addressing global challenges.

Alternative Asset Access

Technology democratizes access to previously institutional-only investments. Tokenized real assets, including maritime vessels, allow smaller investors to diversify into income-producing physical assets with transparent ownership structures.

Digital Asset Integration

Cryptocurrency and blockchain-based investments, when properly sized (typically 1-5% of portfolios), can provide diversification benefits due to low correlation with traditional assets.

Expert Recommendations for 2025

Leading investment firms emphasize the importance of "maximum portfolio diversification" for 2025 market conditions. This includes traditional diversification, as well as exposure to alternative assets, international markets, and inflation-protective investments.

Asset classes that historically have not moved in tandem with U.S. stocks—including international bonds, commodities, and real assets—have proven increasingly valuable as market correlations shift and geopolitical risks intensify.

Practical Implementation Strategies

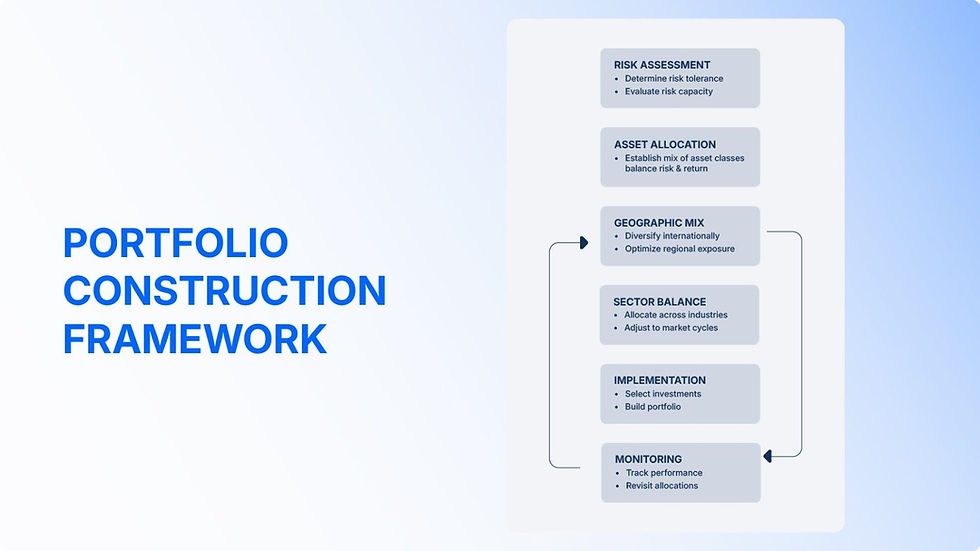

Portfolio Construction Framework

Risk Assessment Foundation

Effective diversification begins with an honest evaluation of risk tolerance. Consider your investment timeline, income stability, and emotional capacity for portfolio volatility. Younger investors typically accommodate higher risk for greater return potential, while those nearing retirement prioritize capital preservation.

Strategic Asset Allocation Models

Age-based allocation (subtracting age from 100 to determine the equity percentage) provides a starting framework, but modern approaches consider multiple factors, including goals, timeline, risk capacity, and market conditions.

Core-satellite strategies combine broad market exposure (core holdings) with targeted opportunities (satellite positions). This approach maintains diversification while allowing tactical positioning in promising sectors or asset classes.

Implementation Tools and Platforms

Low-Cost Diversification Solutions

Index funds and ETFs provide cost-effective exposure to thousands of securities across asset classes and geographies. Total stock market funds, international index funds, and bond index funds form the foundations of diversified portfolios with minimal fees.

Technology-Enabled Solutions

Robo-advisors automate diversification and rebalancing, making sophisticated portfolio management accessible to smaller accounts. Target-date funds provide age-appropriate automatic diversification for retirement accounts.

Alternative Platform Access

Modern platforms enable diversification into previously inaccessible assets. REITs offer real estate exposure without the need for property management. Peer-to-peer lending platforms offer fixed-income alternatives. Tokenized asset platforms allow fractional ownership of maritime vessels, infrastructure, and other real assets.

Monitoring and Maintenance

Rebalancing Discipline

Successful diversification requires systematic rebalancing to maintain target allocations. Quarterly rebalancing typically provides optimal results, forcing disciplined selling of outperforming assets and buying underperforming ones.

Performance Tracking

Monitor diversification effectiveness through correlation analysis and risk-adjusted returns. Effective diversification should reduce portfolio volatility while maintaining the potential for returns relative to concentrated positions.

Cost Management

Minimize fees while maintaining effective diversification. Low-cost index funds, commission-free trading platforms, and tax-efficient strategies preserve more investment returns for compound growth.

Diversification Limitations and Misconceptions

What Diversification Cannot Do

Diversification significantly reduces specific risks but cannot eliminate systematic market risks entirely. During severe market downturns, correlations between asset classes often increase, reducing diversification benefits when they're needed most.

Return Trade-offs Understanding

Diversification typically reduces both risk and return potential compared to concentrated investments in best-performing assets. This trade-off represents insurance against unknown future outcomes rather than guaranteed performance enhancement.

Inflation and Crisis Considerations

Not all diversified portfolios automatically protect against inflation or major economic disruptions. Effective diversification for these scenarios requires the inclusion of specific asset classes and strategic positioning.

Common Misconceptions

Quality vs. Quantity Focus

Holding many investments doesn't guarantee effective diversification. Ten highly correlated technology stocks provide less diversification than three uncorrelated asset classes.

Set-and-Forget Myths

Diversification requires ongoing attention. Market conditions change, correlations shift, and rebalancing becomes essential for maintaining diversification benefits.

One-Size-Fits-All Fallacy

Optimal diversification varies dramatically based on individual circumstances, goals, and market conditions. Cookie-cutter approaches often fail to address the specific needs and situations of individual investors.

Addressing Limitations

Modern portfolio construction employs dynamic allocation strategies that adjust diversification in response to changing market conditions. Risk budgeting techniques allocate risk systematically across different sources rather than simply spreading investments.

Behavioral considerations remain crucial—maintaining diversification discipline during market stress when instincts encourage concentration in "safe" assets or high-performing sectors.

Future of Portfolio Diversification

Technological Evolution

Artificial intelligence and machine learning increasingly enhance portfolio construction and rebalancing. Real-time risk monitoring enables continuous portfolio optimization previously available only to institutional investors.

New Asset Class Development

Digital assets, tokenization technology, and alternative investment platforms create unprecedented diversification opportunities. Maritime asset tokenization exemplifies how technology democratizes access to real-world investments with stable cash flows and low market correlation.

Personalization Advancement

Technology enables customized diversification based on individual preferences, constraints, and goals rather than one-size-fits-all approaches.

Regulatory and Market Evolution

Global market integration paradoxically increases correlation while creating new diversification requirements. Environmental, social, and governance (ESG) factors become increasingly integral to diversification strategies as sustainable investing continues to gain mainstream adoption.

Innovation in emerging markets and the adoption of new technologies create fresh diversification opportunities, while traditional correlations shift due to changing economic structures and increased global interconnectedness.

Conclusion and Actionable Steps

Key Takeaways

Investment portfolio diversification represents one of the few "free lunches" in investing—reducing risk without proportionally sacrificing returns. The mathematical foundation is unshakeable, the historical evidence overwhelming, and the practical necessity undeniable in 2025's volatile market environment.

Effective diversification extends beyond simple asset allocation into geographic spread, sector balance, and time diversification. Modern opportunities include alternative assets, international exposure, and innovative platforms that provide access to previously institutional-only investments.

Risk management diversification isn't about guaranteeing profits—it's about improving the probability of achieving your financial goals while protecting against devastating losses that could derail your wealth-building journey.

Next Steps for Investors

Assessment Phase: Evaluate your current portfolio across all diversification dimensions. Calculate correlations between holdings and identify concentration risks in sectors, geographies, or asset classes.

Education Investment: Understand how different assets behave in various market conditions. Research correlation relationships and study how successful investors structure diversified portfolios.

Implementation Action: Begin with low-cost, broadly diversified index funds for foundation diversification. Gradually add alternative assets, international exposure, and sector-specific investments based on your risk tolerance and investment timeline.

Monitoring Commitment: Establish quarterly portfolio reviews and rebalancing schedules to ensure ongoing alignment with investment objectives. Track diversification effectiveness through risk-adjusted performance metrics rather than simply absolute returns.

The science is clear, the evidence overwhelming, and the tools accessible. In the uncertain market environment of 2025, the question isn't whether you need diversification—it's whether you can afford not to implement it.

FAQS about Investment Portfolio Diversification

What is portfolio diversification and why is it important?

Portfolio diversification involves spreading investments across different asset classes, sectors, and geographies to reduce risk while maintaining return potential.

How much diversification is enough for my investment portfolio?

Effective diversification typically requires 15-25 uncorrelated assets across multiple asset classes, but quality matters more than quantity.

What are the best diversification strategies for 2025?

Modern diversification includes traditional assets, alternative investments, geographic spread, and emerging asset classes like tokenized real assets.

Can diversification protect against market crashes?

Diversification reduces portfolio volatility and specific risks but cannot eliminate all market risks during major economic downturns.

What are common diversification mistakes investors make?

Over-diversification, ignoring correlation changes, home country bias, and failing to rebalance are the most frequent diversification errors.

Dushyant Bisht

Expert in Maritime Industry

Dushyant Bisht is a seasoned expert in the maritime industry, marketing and business with over a decade of hands-on experience. With a deep understanding of maritime operations and marketing strategies, Dushyant has a proven track record of navigating complex business landscapes and driving growth in the maritime sector.

Email: [email protected]