A Complete Guide to Maritime Assets and the Various Types of Commercial Ships

- Dushyant Bisht

- Aug 22, 2025

- 13 min read

Updated: 6 days ago

Introduction: The Unseen Titans of Global Trade

In a single sentence: Maritime assets are the specialized ships and floating infrastructure that form the backbone of global seaborne trade, connecting nations and fueling economies worldwide.

The global economy is like a complex dance where countries are all connected. A quiet but powerful force runs this show: maritime assets. These are the special ships that act as the backbone of our economy. In 2026, these ships are more than just vessels. They're smart, digital, and vital parts of a network that moves over 80% of all global trade. Their huge importance affects supply chains, the price of goods, and even relationships between countries.

This guide is your roadmap to understanding maritime assets in 2026. We'll start with a basic definition of these assets, look at how they've changed over time, and explain the different types of commercial ships sailing today. From huge container ships to special gas carriers, you'll learn about their jobs, what makes them unique, and what gives them their massive value. This is a key exploration for anyone who wants to understand the future of the shipping industry and its central role in shaping global commerce.

What are Maritime Assets?

At its core, the definition of maritime assets encompasses all commercial ships, floating infrastructure, and supporting vessels that are essential for seaborne trade. While the term is most often associated with cargo vessels, it also includes a wide spectrum of specialized craft designed for unique purposes. These assets form the lifeblood of the global supply chain, serving as the physical means of transportation that make international commerce possible.

The scope of a maritime fleet explained includes:

Cargo Ships: Vessels built for general cargo, bulk materials, or standardized containers.

Tankers: Specialized ships for transporting liquid commodities like oil, chemicals, and gases.

Passenger Vessels: Such as ferries and cruise ships, which are critical for travel and tourism.

Specialized Vessels: A diverse category including offshore support vessels (OSVs), heavy lift ships, tugs, and research vessels, each performing a vital, often highly technical, function.

The evolution of these assets is continuous. The modern commercial fleet in 2026 is a far cry from its predecessors, moving beyond traditional steel and sail to embrace digital, eco-friendly, and increasingly automated assets. This includes vessels with alternative fuel systems and real-time monitoring capabilities, all designed to meet the demands of a more sustainable and efficient global economy.

History and Evolution of Commercial Maritime Assets

The story of commercial maritime assets is a long and compelling narrative of human ingenuity. It begins with the sailing ships of antiquity, which, for thousands of years, were the primary means of long-distance trade. The advent of the steam engine in the 19th century marked a pivotal technological leap, replacing sails and enabling predictable, scheduled voyages regardless of wind conditions. This was followed by the transition to steel hulls and then to the far more efficient diesel engine in the early 20th century, which cemented the modern ship's design.

The post-World War II era brought about two of the most significant milestones in the history of commercial shipping. The first was containerization, a revolutionary concept that standardized cargo and enabled the creation of colossal container ships, fundamentally accelerating global trade. The second was the construction of supertankers in response to the global oil boom, culminating in the creation of massive crude carriers like the ULCC (Ultra Large Crude Carrier).

In the present day, the industry is undergoing another profound transformation. Technological leaps like the deployment of digital twins, the integration of real-time monitoring via IoT sensors, and the transition to alternative fuels (LNG, methanol, hydrogen) are reshaping vessel design and operations. This relentless pursuit of innovation has been driven by the need for greater efficiency and, more recently, by the urgent global mandate for environmental sustainability.

Maritime Asset Classification: How Commercial Ships are Categorized

Commercial ships are not a single, uniform category. They are meticulously classified based on their purpose, operation, and physical characteristics. Understanding these classifications is essential for anyone involved in maritime investment or logistics, as a vessel's type and size directly correlate with its function and market value.

The primary way commercial ships are categorized is by cargo:

Dry Cargo Vessels: Carry unpackaged or containerized solids.

Liquid Bulk Vessels: Transport liquid commodities.

Passenger Vessels: Cater to people for travel and leisure.

Specialized Vessels: Perform unique, highly specific tasks.

Beyond cargo, they are also classified by operation (e.g., coastal for short-haul trips, deep-sea for transoceanic voyages) and, most importantly, by size and capacity. These size classifications, often linked to historical canal limitations, define a vessel's market and operational capabilities:

Handymax/Handysize: Smaller bulk carriers with a capacity of up to 60,000 DWT, known for their versatility and ability to access smaller ports.

Panamax: Historically, the maximum size of a ship that could transit the Panama Canal prior to its 2016 expansion.

Suezmax: The maximum size for a ship that can transit the Suez Canal.

VLCC (Very Large Crude Carrier) and ULCC (Ultra Large Crude Carrier): Massive oil tankers used for long-haul crude oil transport.

Feeder, Post-Panamax, and Ultra-Large Container Vessels (ULCVs): The different classes of container ships, differentiated by their TEU capacity.

Major Types of Commercial Ships

The global maritime fleet is a testament to the ingenuity of naval architecture, with each vessel class tailored for a specific function within the global supply chain. This diversity is what gives the industry its immense strategic and economic value.

A. Dry Cargo Vessels

These ships are the workhorses of global trade, carrying the foundational commodities and finished goods that fuel our world.

Container Ships: The most recognizable vessels in modern commerce. They are specifically designed to carry standardized containers (TEUs), which has enabled the massive scale of globalization. They range in size from small feeder vessels for regional routes to colossal Ultra-Large Container Vessels (ULCVs), capable of carrying over 24,000 TEUs.

Bulk Carriers: These vessels are designed to transport unpackaged bulk cargo, such as grains, iron ore, coal, and cement. They are highly efficient for moving vast quantities of raw materials and form the backbone of industrial supply chains. Bulk carriers are classified by their size, from the versatile Handysize and Panamax to the giant Capesize and Newcastlemax vessels.

General Cargo Ships: These are the multi-purpose ships of the fleet. They are adaptable for a wide variety of cargo, from palletized goods to heavy machinery and break-bulk items. Their flexibility allows them to serve trade routes where containerization may not be viable.

Reefer Ships: These are specialized, temperature-controlled vessels designed to transport perishable goods like fresh produce, meat, and pharmaceuticals. They are a critical component of the global cold chain, ensuring that sensitive cargo arrives fresh and intact.

Roll-on/Roll-off (RoRo) Ships: Designed for maximum efficiency, RoRo ships transport vehicles, trailers, and even entire trains. Their ramps allow cargo to be rolled on and off the vessel, drastically reducing port dwell times and streamlining logistics.

B. Liquid Bulk Vessels

These specialized ships are the lifeblood of the global energy and chemical sectors, transporting liquid cargoes with an emphasis on safety and containment.

Oil Tankers: These are among the largest vessels ever built, transporting crude oil and refined petroleum products. They range in size from small Aframaxes (80,000-120,000 DWT) to massive Very Large Crude Carriers (VLCCs) and Ultra Large Crude Carriers (ULCCs), which can carry over 300,000 DWT of crude oil on long-haul voyages.

Chemical Tankers: These are highly sophisticated vessels designed to transport hazardous chemicals, acids, and specialty liquids. They feature multiple independent tanks with specialized coatings or stainless steel to prevent cargo mixing and corrosion. The International Maritime Organization (IMO) has a strict classification system for these ships based on the hazard level of the cargo they carry.

LNG/LPG Carriers: These are highly advanced vessels designed with intricate cryogenic technology to transport Liquefied Natural Gas (LNG) and Liquefied Petroleum Gas (LPG). They maintain the cargo at extremely low temperatures to keep it in a liquid state, making them a crucial link in the global gas supply chain.

Specialized Liquid Carriers: A smaller but vital category includes ships designed for specific liquid cargoes like juice, wine, or molasses, each with dedicated tanks and systems to ensure the product's integrity.

C. Passenger Vessels

Passenger vessels are designed for the transport of people, serving both leisure and daily transit needs.

Cruise Ships: These are essentially floating cities, designed for leisure and tourism. They are equipped with hotels, restaurants, and entertainment facilities, and are a key driver of the global tourism economy. Modern cruise ships are among the largest and most technologically advanced vessels in the world, with a capacity of over 6,000 passengers.

Ferries and RoPax Vessels: Ferries are designed for short-haul passenger transport across rivers, lakes, or coastal waters. RoPax vessels are a hybrid type that combine the function of a ferry (passengers) with a Roll-on/Roll-off (RoRo) ship (vehicles and cargo), making them highly versatile for regional transport networks.

D. Specialized & Multi-Purpose Vessels

This diverse category of ships performs unique and often highly technical functions that are essential for supporting various industries.

Heavy Lift Vessels: These ships are designed to transport oversized and overweight objects that cannot be accommodated by conventional cargo vessels. Their cargo can include everything from oil rigs and large industrial equipment to entire warships and locomotives.

Livestock Carriers: These are specialized vessels with enhanced ventilation, feeding, and waste management systems to ensure the welfare of live animals on long voyages.

Offshore Support Vessels (OSV) and Platform Supply Vessels (PSV): These ships are critical for the energy sector, providing essential support to offshore oil and gas platforms, wind farms, and subsea construction projects. They transport crew, supplies, and equipment to these remote locations.

Semi-Submersible Ships (Flo-Flo): These highly specialized vessels, like the Blue Marlin, have a unique float-on/float-off capability. They can partially submerge their decks to allow cargo to be floated into position, then de-ballast to lift it and transport it across long distances. This is ideal for moving massive, pre-built structures like oil rigs.

Tugs & Salvage Vessels: Tugs are powerful vessels used for towing and maneuvering larger ships in harbors and tight waterways. Salvage vessels are equipped with specialized equipment for rescue operations and recovering distressed vessels or cargo.

Research & Survey Vessels: These are floating laboratories, designed to support scientific, hydrographic, and oceanographic missions. They are equipped with advanced sensors and data collection equipment to help us understand the world's oceans and marine ecosystems.

Key Specifications and Technology

Understanding maritime assets goes beyond their function; it requires knowledge of the technical specifications and technology that define their value and operational capability.

Capacity Measures: The value of a commercial ship is often tied to its capacity. Gross Tonnage (GT) is a measure of the total internal volume of a vessel. Deadweight Tonnage (DWT) is a measure of a ship's carrying capacity, including cargo, fuel, crew, and stores. Twenty-foot Equivalent Units (TEUs) is the standard measure for container ships.

Safety and Navigation Tech: Modern vessels are equipped with advanced technology for safety and navigation, including ECDIS (Electronic Chart Display and Information System), radar, GMDSS (Global Maritime Distress and Safety System), and real-time monitoring systems that provide continuous data on a vessel's location and performance.

Emissions Compliance: The push for sustainability is driving innovation in emissions technology. Vessels are now fitted with scrubbers to reduce sulfur emissions and Ballast Water Treatment Systems to prevent the transfer of invasive species. Metrics like EEXI and CII are used to measure a ship's energy efficiency, influencing its operational value and marketability.

Digitalization: The modern fleet is becoming increasingly digital. IoT sensors on vessels provide real-time data on everything from engine health to cargo temperature. Big data analytics and AI-driven fleet monitoring are used to optimize routes, predict maintenance needs, and enhance overall operational efficiency, creating a digital twin of the vessel for advanced management.

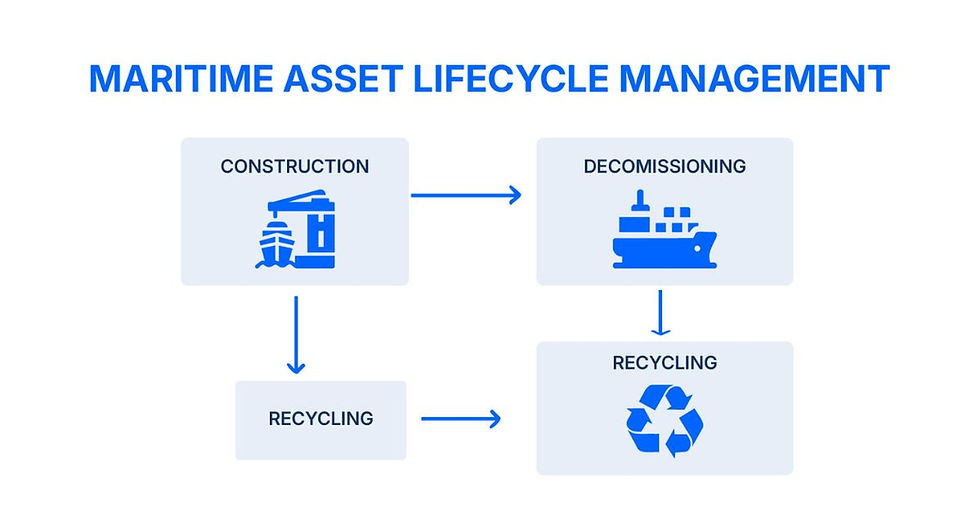

Lifecycle and Management of Maritime Assets

The lifecycle of a maritime asset is a multi-decade journey, from its initial conception to its final decommissioning.

Acquisition, Construction, and Commissioning: This phase involves the initial design, financing, and construction of a vessel. It is a capital-intensive process that can take years, and the final commissioning marks the start of the vessel's operational life.

Operations: This is the longest phase, involving routine and condition-based maintenance, safety protocols, and digital asset management. A vessel's profitability depends on its ability to minimize downtime and maximize operational efficiency.

Decommissioning and Recycling: At the end of its useful life, a vessel is decommissioned. The Hong Kong International Convention sets the international standards for safe and environmentally sound ship recycling, ensuring that ships are dismantled responsibly, and hazardous materials are properly disposed of.

Financial: The financing of maritime assets involves various ownership models, including traditional bank loans, chartering, and leasing. In 2026, new models like asset-backed securities and asset tokenization are emerging as alternatives to traditional financing, offering new opportunities for both owners and investors.

ESG Factors and Compliance: Environmental, Social, and Governance (ESG) factors are now a critical consideration throughout a vessel's lifecycle, influencing everything from financing decisions to operational practices and regulatory compliance.

Regional Leaders and Global Fleet Overview

The ownership and operation of the global maritime fleet are concentrated in key regions and nations.

Top Asset-Owning Nations: Nations like China, Japan, South Korea, Germany, and Greece are among the largest asset-owning nations by deadweight tonnage. Greece, in particular, has a storied history as a dominant force in global ship ownership.

Major Shipping Companies: The industry is shaped by giants like Maersk, MSC, and CMA CGM in container shipping; Stolt-Nielsen and Hafnia in chemicals; and Nakilat and MOL in LNG, among others.

Market Size: The global fleet comprises approximately 100,000 commercial ships, representing a collective carrying capacity of over 1.5 billion gross tonnes. Asia, particularly China, dominates both shipbuilding and fleet ownership, reflecting its central role in global manufacturing and trade.

Trends Transforming the Maritime Asset Landscape (2026)

The maritime asset landscape is undergoing a profound transformation in 2026, driven by a convergence of powerful trends.

Green Ships and Decarbonization: The urgent push for decarbonization is driving a shift towards alternative fuels like LNG, hydrogen, and methanol. This includes the development of hybrid propulsion systems, wind-assist technology, and fuel cells, making green shipping a key focus for innovation and investment.

Digital Transformation: Autonomous vessels, smart shipping systems, and the integration of AI/ML in asset management are optimizing fleet operations, improving efficiency, and enhancing safety.

Supply Chain Resilience: Following recent global disruptions, there is a renewed emphasis on building more resilient supply chains. This has led to an increased focus on the flexibility of maritime assets and proactive risk management in response to geopolitical risks.

Key Regulatory and Compliance Factors

The maritime industry is governed by a complex web of regulatory and compliance standards that directly impact asset value and operations.

IMO and Regional Regulations: International conventions like SOLAS (International Convention for the Safety of Life at Sea) and MARPOL (International Convention for the Prevention of Pollution from Ships) set minimum standards for ship safety and environmental protection. Regional rules, such as the EU's Emissions Trading Scheme (ETS), are also having a significant impact on operations.

Asset Certification and Insurance: Ships require certification from a Classification Society (e.g., Lloyd’s Register, DNV) to ensure safety and seaworthiness. They also need insurance (e.g., from P&I Clubs) to cover liability and operational risks.

Security and Customs: The ISPS Code sets out a comprehensive framework for maritime security, while customs and port authorities have stringent requirements for cargo and crew documentation.

Case Studies: Notable Commercial Vessels

Ultra-Large Container Vessel (ULCV): A modern ULCV can carry over 24,000 TEUs, a feat of engineering that dramatically lowers the cost per container, but requires massive port infrastructure and long-term financing.

LNG Carrier: These vessels are a prime example of innovation in maritime assets. Their advanced cryogenic technology and dual-fuel propulsion systems make them a crucial link in the global energy supply chain.

RoPax Ferry: This hybrid vessel combines passenger and cargo transport, offering a highly efficient and versatile solution for short-sea shipping and regional trade.

Offshore Wind Support Vessel: As the renewable energy industry expands, so does the demand for specialized vessels that install and maintain offshore wind farms, highlighting a new and growing segment for maritime investment.

Challenges and Risks in Maritime Asset Management

Managing maritime assets is not without its challenges.

Economic Risks: The industry is cyclical, prone to oversupply, asset price volatility, and fluctuating freight rates.

Technical Risks: Managing an aging global fleet, and the high costs of sustainability retrofits and technological upgrades, presents a constant challenge. Cybersecurity threats are also a new and growing risk.

Regulatory Risks: Evolving global and regional standards, such as new emissions mandates, create ongoing compliance costs and operational complexities.

Workforce Risks: Attracting and retaining a skilled workforce, and providing adequate training for modern vessels, is a key concern for the industry.

The Future of Maritime Assets: Innovations and Outlook

The future of maritime assets is a story of continuous innovation.

Digitalization and Automation: We are likely to see an increase in modular, autonomous, and "smart" ship designs, driven by advancements in AI and robotics.

Green Propulsion: The push for green shipping and decarbonization will lead to a broader adoption of alternative fuels and energy-efficient technologies.

Asset Tokenization: The potential of asset tokenization for fractional ownership and investment in maritime assets is immense. This innovative financial model could democratize access to ships, unlocking new pools of capital and creating a more transparent and liquid market.

Integrated Ecosystems: We will see the continued integration of ships with smart ports, digital supply chains, and green corridors, creating a seamless and ultra-efficient global logistics network.

The vision for 2035 is a sustainable, automated, and ultra-efficient commercial fleet, powered by innovation and resilience.

Conclusion

Maritime assets will remain the indispensable backbone of world trade, but their role is evolving. This guide has provided a comprehensive overview of the types of commercial ships, their history, and the profound trends shaping their future. From the innovative engineering of specialized vessels to the challenges of decarbonization and digitalization, the maritime industry is at a pivotal moment.

The future of maritime assets is a story of continued innovation, investment in infrastructure, and a relentless drive for efficiency, resilience, and sustainability. It will remain the indispensable backbone of world trade, adapting to the demands of a rapidly changing global landscape.

Call to action: Ready to explore the opportunities in maritime assets?

Disclaimer:

This material is provided for informational purposes only and does not constitute financial, investment, or legal advice. All digital assets carry inherent risks, including potential loss of capital. Past performance is not indicative of future results. Please review the relevant offer and risk disclosures carefully before making any financial decision.

FAQs about Maritime Assets

What are maritime assets?

Maritime assets are commercial ships, vessels, and floating infrastructure that form the backbone of global seaborne trade, including cargo ships, tankers, container vessels, and various specialized support vessels.

What are the major types of commercial ships?

Commercial ships are broadly categorized into Dry Cargo Vessels (container ships, bulk carriers), Liquid Bulk Vessels (oil, chemical, and gas tankers), and Passenger Vessels (cruise ships, ferries).

How are commercial ships classified by size?

Ships are classified by size and capacity, with common terms including Handymax, Panamax, Suezmax, VLCC (Very Large Crude Carrier), and ULCC (Ultra Large Crude Carrier), often linked to canal and port dimensions.

What is the lifecycle of a maritime asset?

The lifecycle of a maritime asset includes its acquisition and construction, decades of operation with regular maintenance and digital management, and eventual decommissioning and recycling under international standards like the Hong Kong Convention.

How is technology changing maritime asset management in 2026?

Technology is enabling digital asset management with IoT, AI-driven monitoring, and blockchain, while new propulsion systems and designs are being developed to meet sustainability and decarbonization goals.

Dushyant Bisht

Expert in Maritime Industry

Dushyant Bisht is a seasoned expert in the maritime industry, marketing and business with over a decade of hands-on experience. With a deep understanding of maritime operations and marketing strategies, Dushyant has a proven track record of navigating complex business landscapes and driving growth in the maritime sector.

Email: [email protected]