How Do RWA Earnings Actually Work? A 2026 Guide

- Dushyant Bisht

- Sep 30, 2025

- 6 min read

Updated: Jan 13

Quick answer: How do RWA earnings actually work in 2025?

RWA earnings usually come from two places:

Operational earnings – the real-world cash generated by the asset doing its job (for example, charter income from a ship after operating costs).

Changes in asset value – how the underlying asset’s market value moves over time in the sale and purchase market.

These earnings are not guaranteed and depend on performance, market conditions and the specific structure used.

"Real-World Asset" (RWA) is one of the most talked-about concepts in finance. But in a conversation dominated by digital platforms and token prices, a critical question is often left unanswered: How do you actually get paid?

Most explanations are vague. They mix up token price speculation, platform fees, and the asset's underlying value, leaving aspiring owners confused.

This is a problem. To confidently assess an RWA, you must be able to separate the two distinct, independent mechanisms that determine its value:

The asset's operational earnings (the value it generates by doing its job).

The asset's market valuation (the value of the asset itself in a global market).

This guide breaks down both, using the tangible, heavy-industry example of a maritime asset.

First, What Is an RWA? (The Legal Framework)

An RWA token is not just a digital idea; it is a legal claim. The tokenization process "wraps" a tangible asset in a secure legal and digital structure.

This process is built on a cornerstone called the SPV (Special Purpose Vehicle). Think of an SPV as a digital "vault" or a distinct legal company created for one purpose: to hold one specific asset.

At Shipfinex, for example, a single ship is placed into its own unique SPV. The ownership (equity) of this SPV is then digitized into tokens, which we call Maritime Asset Tokens (MATs). This is not a "utility token"; it is a legal, fractional share of ownership in the company that owns the ship.

This legal framework is what gives you a direct claim on the asset's value.

Mechanism 1: Pro-Rata Earnings from Asset Operations

This is the value the asset generates by doing its job.

A real-world asset is an operating business. A commercial building's "job" is to house tenants, and it generates earnings from rent. A ship's "job" is to transport cargo, and it generates earnings from charterers (the companies renting the ship).

This is not a passive number. It is the result of a clear financial process.

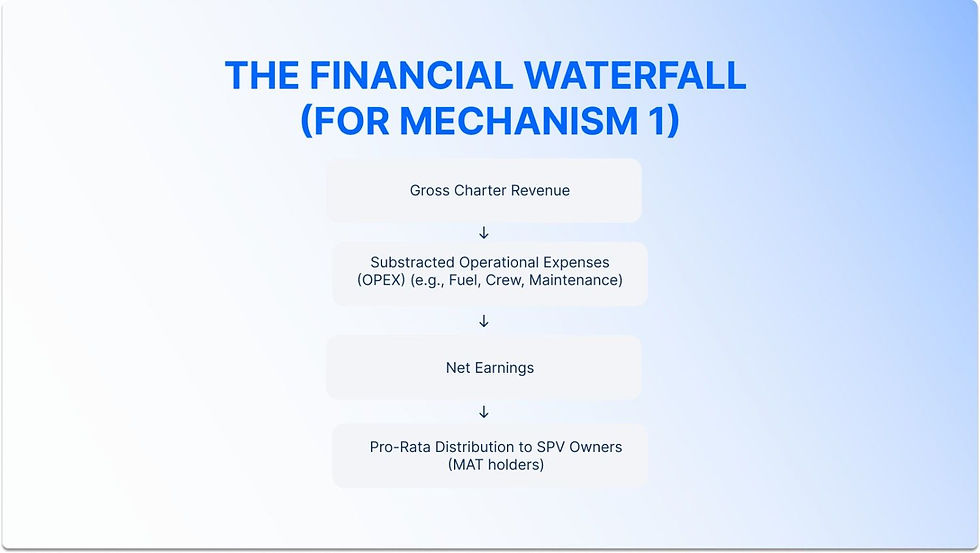

How the Financial Waterfall Works

Gross Revenue: The ship is hired for a charter, generating a set amount of revenue.

Operational Expenses (OPEX): This gross revenue is not profit. It is first used to pay all real-world costs associated with running the asset. This includes crew salaries, fuel (bunkers), insurance, port fees, maintenance, and management fees.

Net Earnings Distribution: After all operational bills are paid, the remaining net earnings are distributed pro-rata to the SPV's legal owners, the token holders.

Key Takeaway: This is fundamentally different from a stock "dividend," which is a portion of a company's profit decided by a board. This is a direct pro-rata distribution of business earnings to the legal owners of the asset.

Mechanism 2: Asset Value in the S&P Market

This second mechanism is completely independent of the first. This is the value of the asset itself.

A ship is a major capital asset, and its value fluctuates in a global marketplace, just like real estate. In shipping, this is called the Sale & Purchase (S&P) market. A ship's S&P value is what it could be sold for today, regardless of what it is earning on its current charter.

What Drives the S&P Market?

This market is famously cyclical. An asset's value can increase or decrease based on powerful, global forces.

Global Trade Demand: When global trade is high, more goods need to be moved, which increases the demand for ships and can put upward pressure on their value.

Vessel Supply: Shipyards are constantly building new ships. If the "orderbook" (the number of new ships being built) is high, it can increase the total supply of ships, which can put downward pressure on the value of existing ones.

Asset Specifications: This is where it gets nuanced. A ship's age, maintenance record, and fuel efficiency (its "eco-class") are critical. A modern, eco-class ship compliant with new IMO 2030 environmental regulations will be valued very differently from an older, less efficient ship.

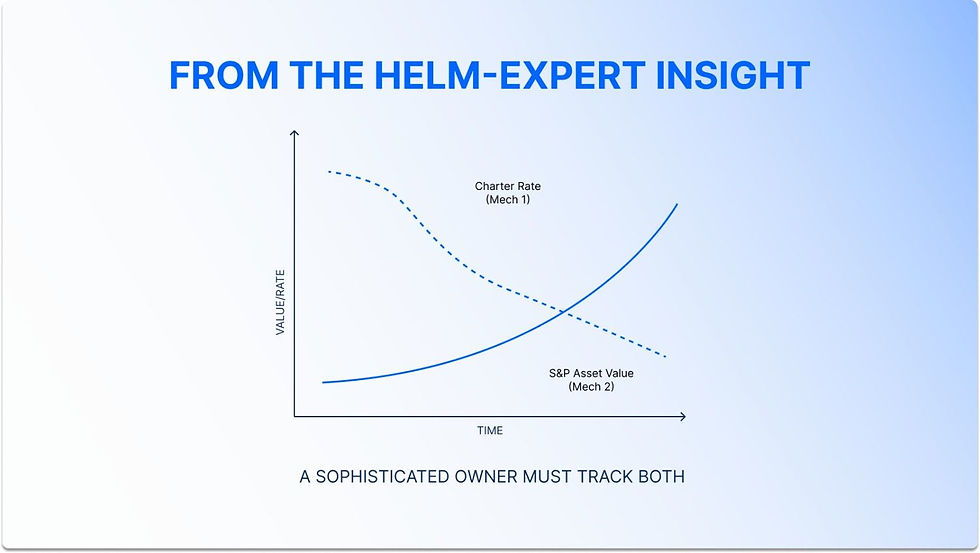

"From the Helm": Don't Confuse the Two

This is the most common mistake we see new participants make: they fail to assess these two mechanisms independently.

Common Mistake: An aspiring owner might see an older ship (e.g., 15 years old) in a high-demand market, earning very high charter rates (Mechanism 1). They might assume this is a great deal. However, the ship's underlying S&P value (Mechanism 2) might be steadily declining as it ages and gets closer to being non-compliant with new environmental rules.

Expert Insight: Conversely, a brand-new, eco-class ship (Mechanism 2) might be locked into a lower-earning charter contract for its first year (Mechanism 1). A novice might overlook it, but a sophisticated owner understands that the asset's underlying S&P value is strong, as it is positioned to compete for the next 20 years.

A sophisticated owner must be able to assess both. You are not just looking at a "yield"; you are evaluating a business and a capital asset, simultaneously.

The Shipfinex Role: A Platform for Transparency

This brings us back to the Shipfinex platform. Our role is to be 100% compliant, which means we are not financial advisors and we never provide advice.

Our role is to be a regulated platform that provides the data for you to assess both mechanisms with clarity.

For Mechanism 1 (Earnings): Our platform provides access to the asset's historical operational data, charter contracts, and transparent, auditable ledgers for all earnings distributions.

For Mechanism 2 (Value): We provide a comprehensive data room with the ship's full specifications: its age, its eco-class, its maintenance history, its compliance status, and access to independent, third-party valuation reports.

Our job is to provide the tools for you to conduct your own comprehensive due diligence. We believe that a transparent, well-informed customer is the foundation of a healthy market.

Conclusion: From Vague "Yield" to Clear Mechanisms

RWA value is not a vague promise of "yield" from a speculative token.

It is the combined, measurable, and auditable result of two distinct forces: the net earnings from its real-world business operations and its fluctuating value in a global secondary market.

By separating these two mechanisms, you can move from being a hopeful participant to being a sophisticated, informed owner who truly understands the asset you are evaluating.

Points to Remember:

RWA earnings start with the real activity of the asset (for example, a ship carrying cargo and earning charter income).

After operating expenses, whatever is left at the asset level can contribute to earnings.

Over time, the market value of the asset itself can move up or down.

Together, these factors shape how RWA earnings behave in the real world.

None of these are guaranteed and they all depend on market, performance and structure.

Take the Next Step

Register for access to our secure portal to review asset documentation.

FAQS

How do RWA earnings actually work?

RWA earnings typically come from two components. First, the asset can generate earnings through its daily operations, such as revenue after operating costs. Second, the asset’s market value can move up or down over time. Together, these factors shape the overall earnings profile of a real-world asset, and none of them are guaranteed.

What are the two main ways RWAs generate value?

RWAs have two value mechanisms: 1. Pro-rata earnings from the asset's real-world operations (e.g., charter revenue from a ship). 2. Changes in the asset's underlying market value (e.g., its price in the Sale & Purchase market).

What is an SPV in RWA tokenization?

An SPV (Special Purpose Vehicle) is a distinct legal entity created to hold a single asset. Tokenizing the SPV's ownership is the secure, legal method for representing fractional ownership in the underlying real-world asset.

Are RWA earnings guaranteed?

No. All investments carry significant risk. Operational earnings depend on market demand and expenses, and the asset's underlying value can fluctuate, potentially leading to loss. Past performance is not an indicator of future results.

Disclaimer

This content is for informational and educational purposes only and does not constitute financial advice, investment recommendations, or an offer to sell securities. All investments carry significant risk, including operational challenges, market volatility, and potential for total loss. This is a high-risk asset class. Past performance is not an indicator of future results. Please review all offering documents and the full Risk Disclosure Statement before making any ownership decisions. Consult with appropriate financial, legal, and tax advisors.

Dushyant Bisht

Expert in Maritime Industry

Dushyant Bisht is a seasoned expert in the maritime industry, marketing and business with over a decade of hands-on experience. With a deep understanding of maritime operations and marketing strategies, Dushyant has a proven track record of navigating complex business landscapes and driving growth in the maritime sector.

Email: [email protected]